Learn How To Build Your Own Tax Preparation Business With Zero Experience

Learn How To Build Your Own 6-Figure Tax Preparation Business With Zero Experience

Hi, I’m Irene Day...

Hi, I’m Irene Day...

I’ve been in the financial space since 2017 and started offering tax preparation as a service in 2018, earning $30,000 in my first tax season in tax revenue alone. And since then, I’ve made well over 7-figures in revenue, with most of my income coming from my tax preparation business.

In 2021, the 4th tax season I offered this service, I made $300,000 in tax revenue alone. And this year, my goal is to hit $600,000.

And all these years, I’ve had people come up to me, asking for help to build their own tax preparation business, and earn a 6-figure income. But as much as I’d love to help each and every one individually, I only have so much time and energy to do so.

So I created a learning platform where I could share all the lessons I’ve picked up over the years, and the strategies I used to build my business from scratch to where it is today, so more and more people can take advantage of this huge and lucrative industry that is constantly growing.

And now, I’m more than happy to share all of these with you…

Hi, I’m Irene Day...

I’ve been in the financial space since 2017 and started offering tax preparation as a service in 2018, earning $30,000 in my first tax season in tax revenue alone. And since then, I’ve made well over 7-figures in revenue, with most of my income coming from my tax preparation business.

In 2021, the 4th tax season I offered this service, I made $300,000 in tax revenue alone. And this year, my goal is to hit $600,000.

And all these years, I’ve had people come up to me, asking for help to build their own tax preparation business, and earn a 6-figure income. But as much as I’d love to help each and every one individually, I only have so much time and energy to do so.

So I created a learning platform where I could share all the lessons I’ve picked up over the years, and the strategies I used to build my business from scratch to where it is today, so more and more people can take advantage of this huge and lucrative industry that is constantly growing.

And now, I’m more than happy to share all of these with you…

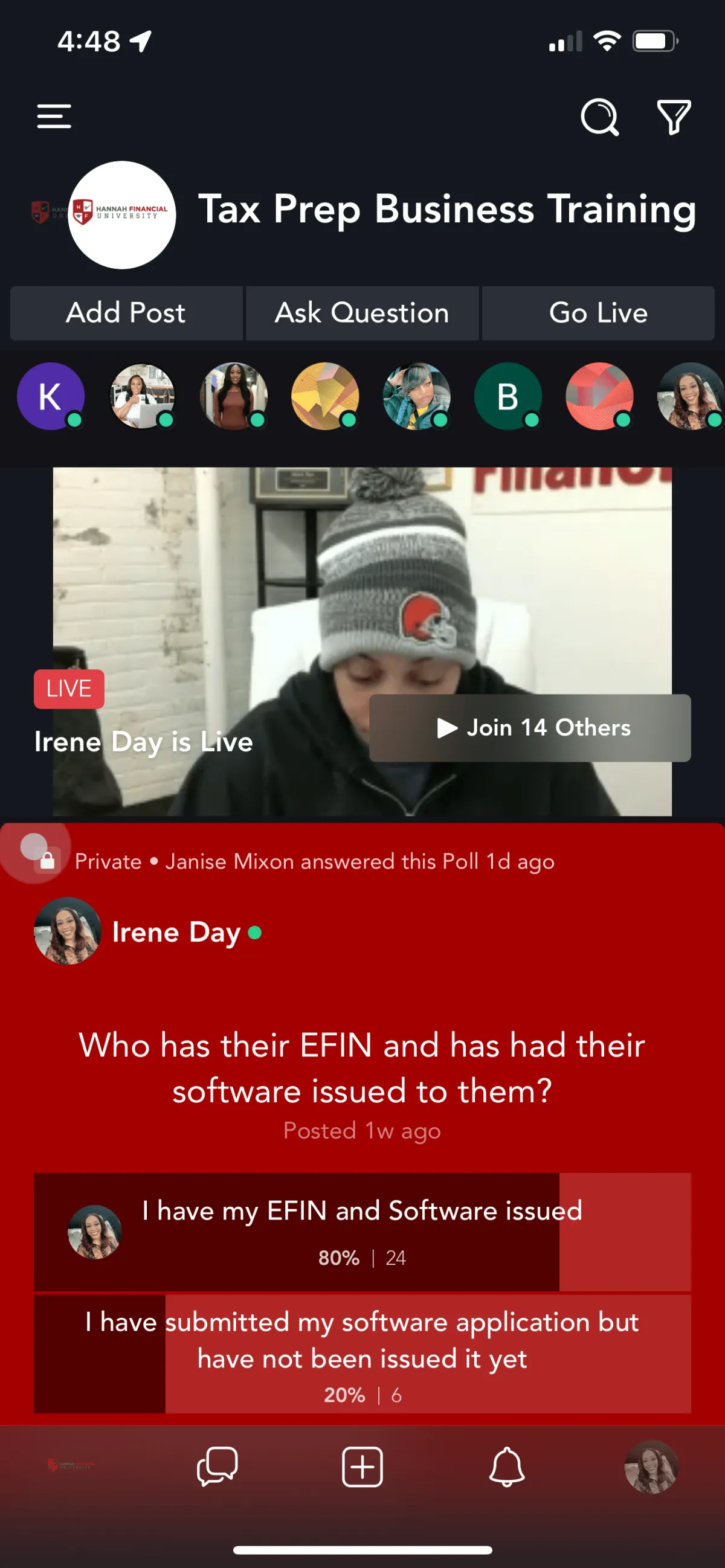

Hannah Financial University Presents:

Tax Preparation Business Training

And with the upcoming changes in the rules and regulations set by the IRS - including taking away the option for people to file their own taxes - this industry is going to explode even bigger within the next 5 years.

Now, I’m giving you the chance to acquire the skills, tools, and resources needed to get into and take advantage of this lucrative industry, even with zero knowledge and experience, so you can build your own tax preparation business and create your own wealth.

Who Is This Business Training For?

But the truth is, you don’t need to have a degree to offer this service, nor do you need years of experience.

And that’s why I’ve designed this training program to work for almost everyone, regardless of prior experience, knowledge, and skills by teaching what you need to know to build your business from scratch, in a comprehensive, step-by-step, and easy-to-follow structure.

- People wanting to achieve financial freedom - for themselves and for their families - by building and growing their own business

- People with zero business experience - regardless of the industry - and looking to change the trajectory of their financial life

- People looking for a way to create their own wealth and leave their 9-5 jobs, and to become their own boss

-

People who want to take back control of their time and energy, and be able to decide how to live their lives, without being at the mercy of their employers.

Here Are Just Some Of The Things You’ll Learn Inside:

What You’ll Get Inside...

Hannah Financial University’s Tax Preparation Business Training

Individual Tax Preparation Training

Proper Business Formation Training

IRS Circular 230 Ethical Standards Training

IRS E-Services Registration Training

FREE Professional Web-Based Tax Preparation Software

Marketing Templates

Secured Client Intake Forms and Agreements

Covid Relief Tax Law Updates

Sales Funnel Templates

Bookkeeping Course From A Quickbooks Online Pro Advisor

Option To Offer $6,000 Cash Advances to Your Clients (With Bank Approval)

Total Value: $7,958

Join Today And You’ll Also Get These Bonuses:

Value: $297

Value: $297

Value: $200

Value: $397

Value: $2,597

Value: $997

$12,143

BUT, if you act today, you can… Get Access For Only $749

“But Can’t Afford Paying For Full Price Upfront…”

But I understand not everyone can afford to pay for the full price of the course upfront. That’s why I’m also offering to let you join this program through an alternative payment option.

Three Payments of $647

This will help you save up for the price of the course and join right away, without having to wait until you have the full amount.

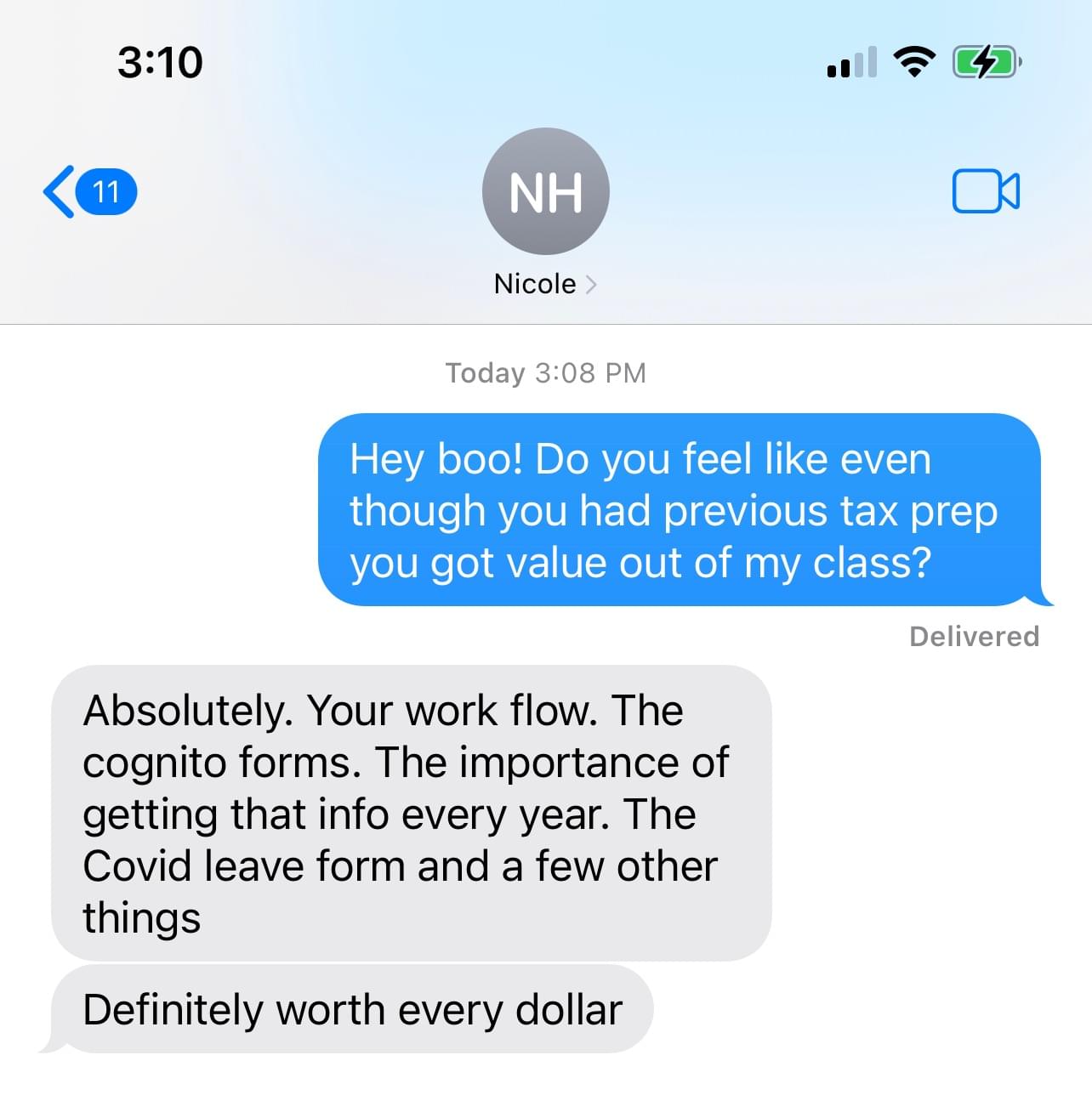

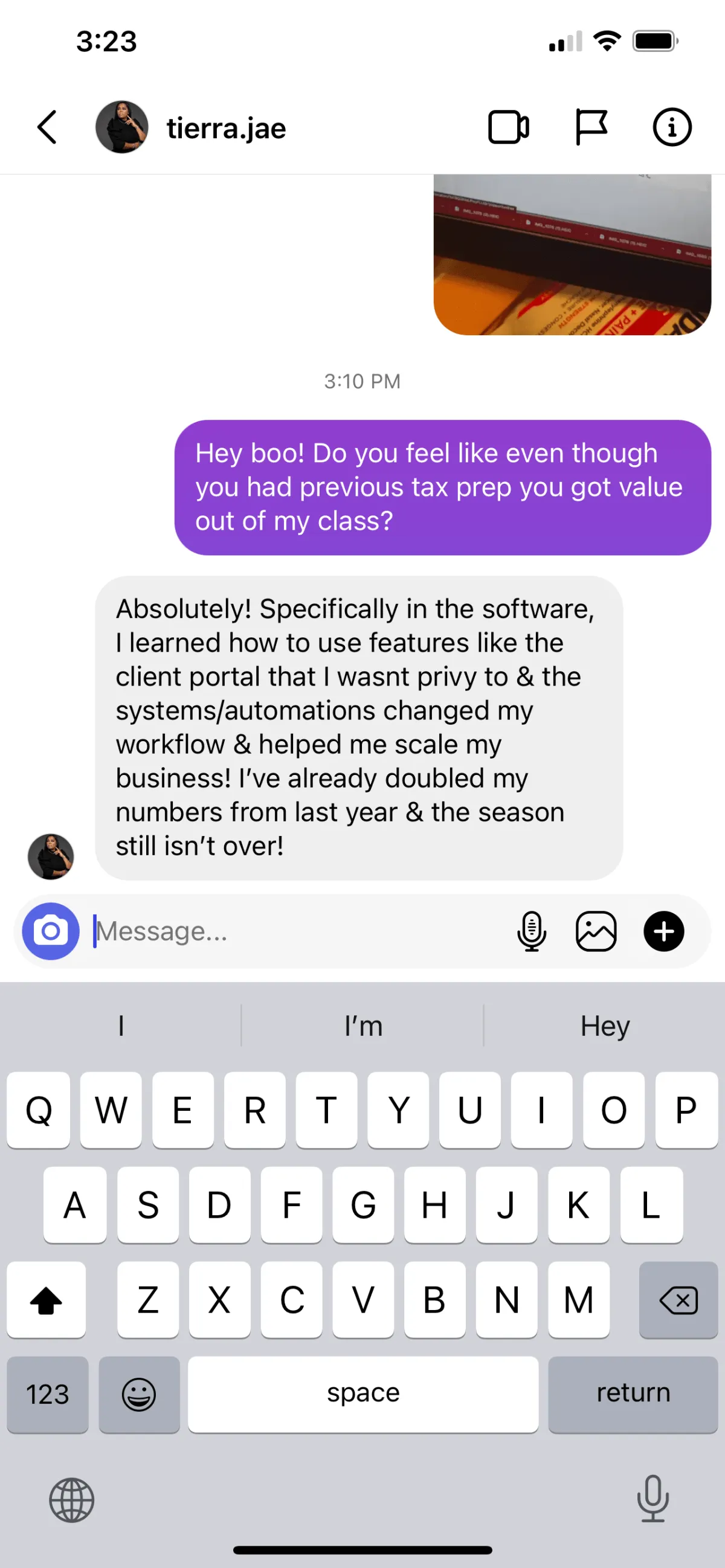

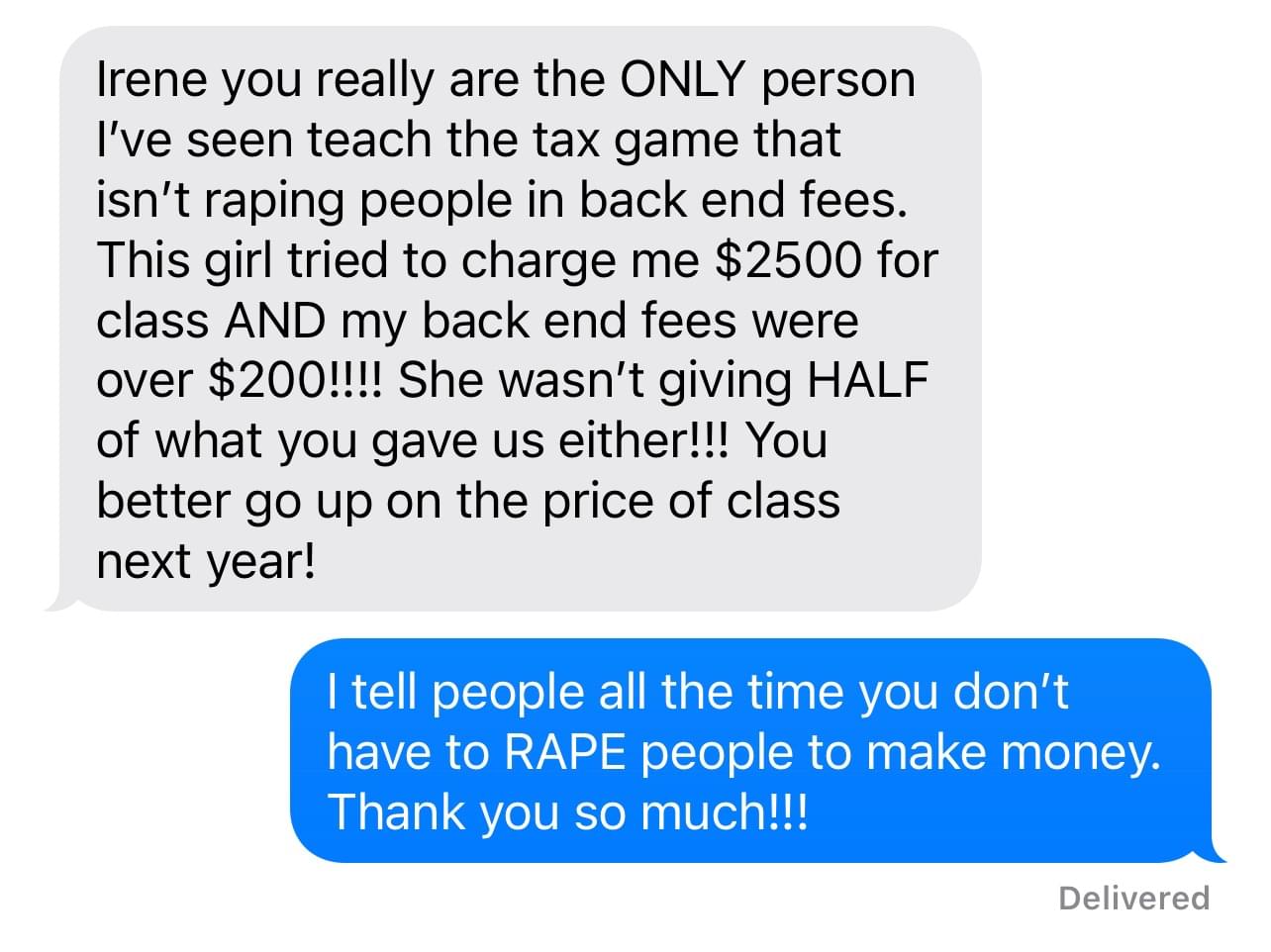

See What Others Has To Say About Irene's Training

Summary Of What You’ll Get Inside...

Hannah Financial University’s Tax Preparation Business Training:

Individual Tax Preparation Training (Value: $297)

Proper Business Formation Training (Value: $297)

IRS E-Services Registration Training (Value: $197)

FREE Professional Web-Based Tax Preparation Software (Value: $1,997)

Marketing Templates (Value: $2,000)

Sales Funnel Templates (Value: $979)

PLUS You’ll Also Get These Bonuses:

Access to Private Inner Circle (Value: $297)

Weekly Live Zoom Coaching Calls (Value: $297)

20 Hours Of IRS Approved Continuing Education (Value: $200)

In-Season Tax Prep Support (Value: $397)

Unlimited IRS E-filing For All States (Value: $2597)

Custom Mobile App For Your Tax Firm (Value: $997)

1 ON 1 CALL WITH IRENE before class starts (PRICELESS)

Today’s Price:

$749

One-Time Payment: $749

Three Payment of $647

Frequently Asked Questions...

The course is completely online and will run 10 weeks. You will be ready for this upcoming tax season.

Yes, it's self-paced and you can go back and review modules when needed.You can start immediately so get started today. The training is provided weekly, but you can always go back to past weeks'training to get a deeper understanding or to refresh your memory.

You will have access to the learning platform for 1 year after the course ends.

Yes! You will learn how to prepare business taxes. There will also be basic bookkeeping training done by Hannah Financial's certified Quickbooks Pro Advisor.

No. Corporate taxes are considered advance tax situations and will be offered in our upcoming advance training.

You do not need any certifications to prepare taxes professionally. You do need CE (Continuing Education) hours with the IRS to keep your tax preparer registration active. These are included in our course.

Yes, but only until the class starts. Once it starts, you will not be able to get a refund. But if you stick with the course, I'm confident you'll be able to multiply the investment you'll make on this course in just one tax season.

After course completion, you will be a registered tax preparer with the IRS and have 22 hours of IRS-approved continuing education.

Registration Is Open NOW!

However, I can’t assure you that the enrollment fee will stay the same. We might add new content, tools, and resources and increase our pricing accordingly.

So if you’re interested in building your 6-figure Tax Preparation Business and start earning money this tax season, don’t waste time and join the training now!

Copyright © 2023 | Terms of Service | Privacy Policy